Climate Change and Nature, Opportunities and Risks

Overview

Welcome to this brief introduction to climate and nature opportunities and risks for business. This section will introduce you to the pivotal role of board directors in steering your business through a net-zero and just transition that maximises the opportunities and minimises the risks.

Why now?

In recent years, the duties of board directors have evolved significantly in relation to climate and nature action due to an increased understanding of the material, financial and systemic risks associated with climate change and nature loss. As a board director, you are now expected, and in many jurisdictions legally mandated, to ensure that your organisation has established appropriate mechanisms and resources to identify and assess significant climate and nature opportunities and risks. It is also seen as your duty to ensure that these issues are properly addressed and disclosed.¹

It is important for board directors to understand that effective climate governance goes beyond focusing solely on risks. By adopting a narrow focus, you might overlook potentially significant opportunities that good climate governance can bring to your organisation. Integrating the climate and nature-related risks and opportunities into the development of corporate strategy, risk management oversight, governance and disclosure ensures directors are better equipped to make informed decisions and to fulfil their obligations to their companies.

Addressing interconnected environmental problems requires integrated strategies. Increasingly, investors, companies, and stakeholders recognise that biodiversity, natural capital, and ecosystems are essential to effective climate strategies. For instance, healthy ecosystems serve as carbon sinks, whilst climate change exacerbates biodiversity loss. A holistic approach is crucial for solving the climate crisis.

What you need to do

As a board director, you should ensure that climate and nature risks and opportunities are well understood and are being effectively managed in a way that is integrated throughout your organisation's governance structures and operational teams. Whilst appointing specific climate experts (such as a Head of Sustainability or a Sustainability Team) will be useful in driving change, this will not, in itself, deliver the broader climate integration required.

Aim for climate management to be a shared responsibility and send a clear message that climate competence is a top priority in your organisation.

To achieve effective management of climate opportunities and risks, you may want to enable your organisation to:

- Measure its greenhouse gas (GHG) emissions.

- Report and disclose those GHG emissions and set targets to reduce them.

- Establish a credible transition plan towards net-zero GHG emissions.

- Deliver the climate ambitions of the plan, monitoring progress and adjusting accordingly.

Transition plans should be updated at minimum every five years and progress should be reported annually. These must include²:

- Short, medium and long-term GHG emission reduction targets.

- Third party verification and auditing methods.

- Adjustments to budgets, capital expenditures, research and development investments.

- Objectives to align all areas of the business to such plans.

- References to trajectories of other organisations from the same sector that have implemented adequate actions.

Taking a more holistic approach that integrates nature in addition to climate, directors should ensure their organisation does the following:

- Assess: highlight the organisation’s material impacts, dependencies, risks, and opportunities related to nature and their integration into the organisation’s strategy and financial planning.

- Commit: define the organisation’s ambition, targets and milestones for contributing to a nature-positive world and outline progress monitoring plans.

- Transform: explain planned actions, stakeholder engagement, and governance structures to implement the nature strategy effectively.

- Disclose: detail steps to ensure strategy credibility and alignment with reporting standards for transparent communication.

Climate and nature opportunities for business

Climate change is often presented in terms of risk, but there are also many opportunities arising from the low-carbon transition. By taking climate and nature action, your organisation can benefit from reduced operational costs, climate-smart innovation and longer-term resilience.

This can be achieved in several ways:

Energy efficiency measures

Switch to renewable energy

Nature-based solutions

New products and services

Integrated balance sheets

Internal carbon pricing

Green bonds

Greenhouse Gas Removal (GGR) technologies

Climate and nature risks for business

It is estimated that between now and 2100, the potential financial losses arising from climate change could run from $4.2 trillion to as much as $43 trillion. The World Economic Forum estimates that over half of the world’s GDP, $44 trillion of economic value, is at moderate or severe risk due to nature loss. Addressing climate change and nature loss now not only outweighs the cost of climate mitigation in a warmer planet, but also helps to reduce risks of increasing climate impacts while offering social and economic benefits.

Physical risks

Risks resulting from the physical effects (acute or chronic) of climate change or nature loss – such as hurricanes, floods, droughts, sea level rises and ecosystem collapse. Physical risks could seriously damage or disrupt the organisation’s operations and supply chain reducing its capacity to operate profitably and sustainably.

Transition risks

Transition risks are those risks that arise in the transition to a low-carbon and nature-positive economy. Transition risks include policy and legal, technology, market and reputational risks relating to climate change and nature loss.

Broader context

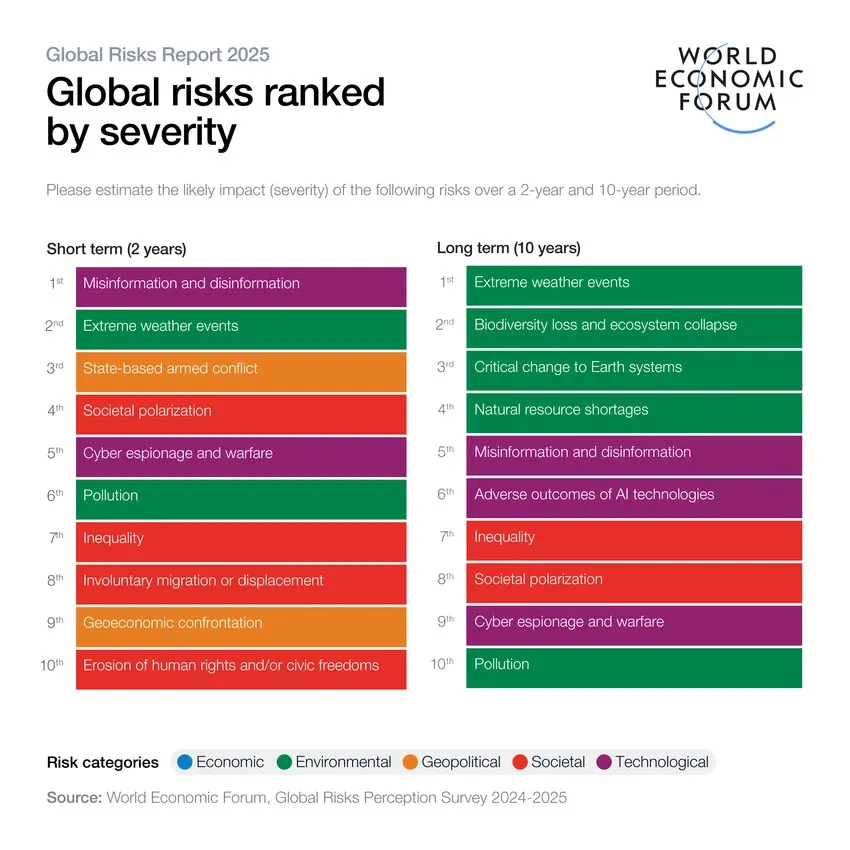

Environmental concerns dominate half of the top 10 global risks, according to a survey among academics, businesses, governments, international organisations and civil society carried out by the World Economic Forum³.

In the short term, extreme weather events ranks as the second most critical global risk. The burden of climate change is becoming more evident every year, and long-term threats like pollution are starting to be perceived with more certainty as short-term realities, as their effects become more apparent. Climate change is also an underlying driver of several other risks that rank high in the short-term, such as involuntary migration or displacement.

In the longer term, climate change will become the foremost global risk – and is the risk for which we are least prepared. Nearly all environmental risks are included in the top 10 long-term ranking. Extreme weather events are anticipated to become even more severe, with the risk ranked first over the next decade, followed by biodiversity loss and ecosystem collapse, critical change to earth systems, natural resource shortages and pollution.

How to take action

Invite your organisation’s board to reflect on the following questions:

- Are we thoroughly assessing our GHG emissions, climate risks and opportunities, both within our operations and across our whole value chain?

- Are we assessing our impact and dependencies on nature? If not, what steps must we take to do so?

- How aware is our board of the risks and opportunities presented by climate change, nature loss and action to address both?

- Has our organisation conducted a risk and opportunities analysis, for example, scenario-based analysis, to understand its climate and nature implications across its operations and value chain?

- How is climate and nature risk and action embedded in our board operations and governance structure?

- How climate and nature competent is our board? Is there a good understanding of climate and nature ambition and transition plans?

Mark section as complete

Join a Chapter

Your regional Chapter can support you with tools and resources to enable effective corporate climate governance in your region.

Join a ChapterResources

1 Climate Governance Initiative (2024). Directors’ Duties Navigator: Climate Risk and Sustainability Disclosures. https://hub.climate-governance.org/resource/directors-duties

2 UN High‑Level Expert Group on the Net Zero Emissions Commitments of Non-State Entities (2022). Integrity Matters: Net Zero Commitments by Businesses, Financial Institutions, Cities and Regions. high-levelexpertgroupupdate7.pdf (un.org)

3 World Economic Forum, in partnership with Marsh McLennan and Zurich Insurance Group (2025). The Global Risks Report 2025, 20th edition. Online access: https://reports.weforum.org/docs/WEF_Global_Risks_Report_2025.pdf

Further Resources

- Further information on Directors’ duties regarding climate change and nature in the Climate Governance Initiative Navigator.

- Read more about the material financial risks and opportunities, and directors’ duties of loyalty and care, related to nature loss in the Climate Governance Initiative’s guide.

- Learn more about the climate and nature nexus in The Climate-Nature Nexus: A Primer on the Way to Cali.

- For more examples of companies leveraging opportunities arising from the low-carbon transition, view the Climate Governance Initiative’s collection of case studies.